Comprehensive Business Plan

Geodyn Solutions 1000 MW Clean Coal Power Plant with CO₂ Algae Ponds, Greenhouse Integration, MSW, and Tire Recycling

Executive Summary

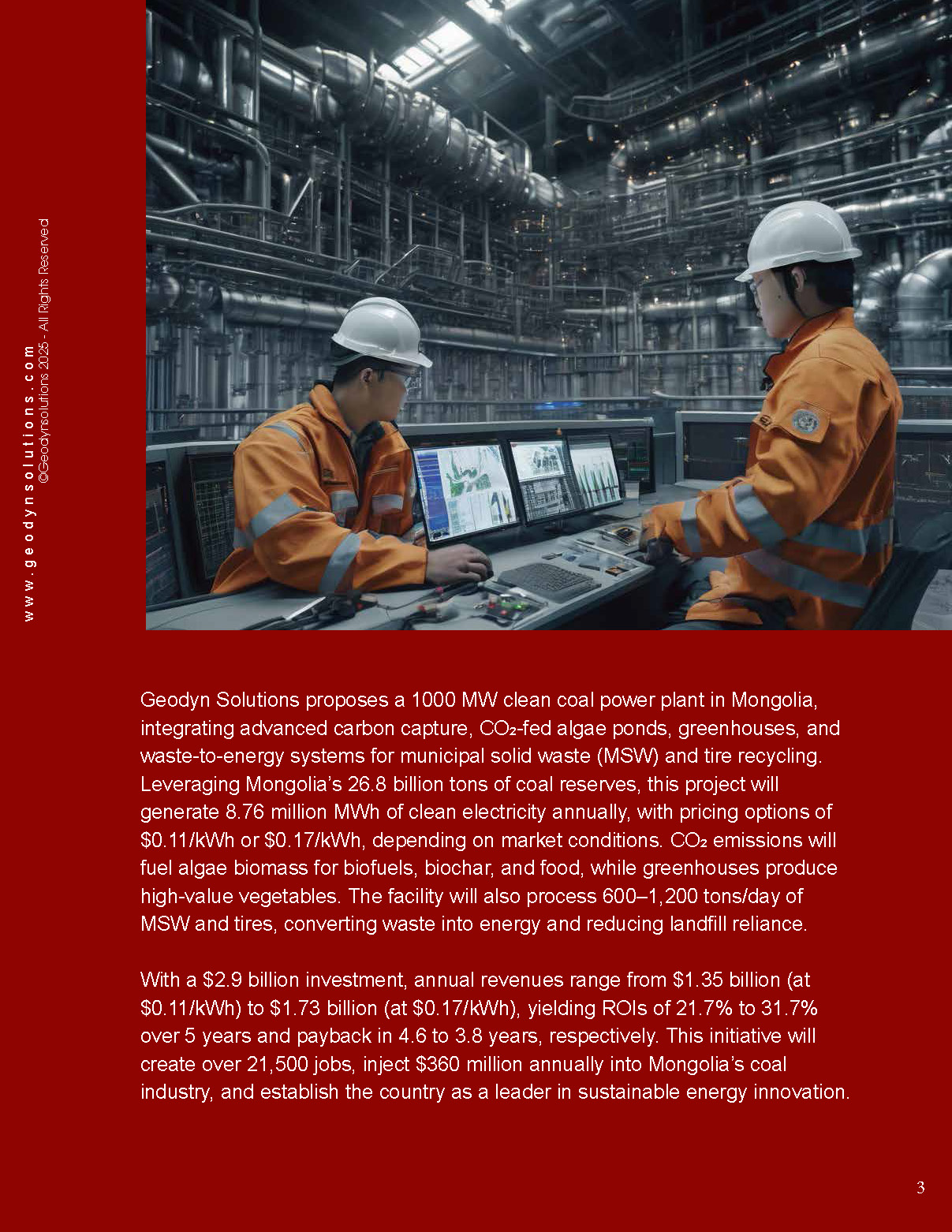

Geodyn Solutions proposes a 1000 MW clean coal power plant in Mongolia, integrating advanced carbon capture, CO₂-fed algae ponds, greenhouses, and waste-to-energy systems for municipal solid waste (MSW) and tire recycling. Leveraging Mongolia’s 26.8 billion tons of coal reserves, this project will generate 8.76 million MWh of clean electricity annually, with pricing options of $0.11/kWh or $0.17/kWh, depending on market conditions. CO₂ emissions will fuel algae biomass for biofuels, biochar, and food, while greenhouses produce high-value vegetables. The facility will also process 600–1,200 tons/day of MSW and tires, converting waste into energy and reducing landfill reliance.

With a $2.9 billion investment, annual revenues range from $1.35 billion (at $0.11/kWh) to $1.73 billion (at $0.17/kWh), yielding ROIs of 21.7% to 31.7% over 5 years and payback in 4.6 to 3.8 years, respectively. This initiative will create over 21,500 jobs, inject $360 million annually into Mongolia’s coal industry, and establish the country as a leader in sustainable energy innovation.

Project Overview

Goals and Objectives

- Generate 8,760,000 MWh of electricity annually with 90% CO₂ capture via ultra-supercritical coal technology.

- Repurpose 4.5 million tons of CO₂ yearly into algae biomass (75%) and greenhouse enrichment (25%).

- Produce 365,000 tons of bio-oil, syngas, and biochar; 36,500 tons of vegetables; and 73,000 tons of algae-based food.

- Convert 219,000–438,000 tons of MSW and tires annually into 109,500–219,000 MWh of energy.

- Drive $360 million in annual coal demand ($60/ton), stabilizing Mongolia’s coal sector.

- Create 15,000 construction jobs and 6,500 permanent jobs.

- Support Mongolia’s low-carbon transition and global sustainability goals.

Location

– Proposed Site: Industrial zone near coal reserves (e.g., South Gobi), with rail/road access.

– Land Requirement: 1,000 acres.

Key Features

1. Clean Coal Power Plant

– Capacity: 1000 MW (8.76 million MWh/year).

– Technology: Ultra-supercritical combustion, 90% carbon capture.

– Purpose: Base-load power for domestic and export markets (e.g., China).

2. Algae Cultivation Facility

– Area: 500 acres of raceway ponds.

– CO2 Input: 3.375 million tons/year.

– Output: 730,000 tons/year of algae biomass (~2,000 tons/day).

3. Greenhouses

– Area: 150 acres.

– CO₂ Input: 1.125 million tons/year.

– Output: 36,500 tons/year of vegetables ($1,000/ton).

4. MSW and Tire Recycling Facility

– Capacity: 600–1,200 tons/day (219,000–438,000 tons/year).

– Output: 109,500–219,000 MWh/year of electricity.

5. Pyrolysis Plant

– Output: Bio-oil (365,000 tons/year), syngas (219,000 tons/year), biochar (146,000 tons/year).

Economic and Environmental Benefits

Economic Impact

1. Coal Industry Support

– Coal Use: 6 million tons/year.

– Revenue for Coal Sector: $360 million/year ($60/ton).

2. Job Creation

– Construction: 15,000 direct, 30,000 indirect jobs.

– Operations: 6,500 permanent jobs.

3. GDP Contribution

– Annual Revenue: $1.35B ($0.11/kWh) to $1.73B ($0.17/kWh).

– Tax Revenue: $200–350 million/year.

4. ROI Comparison

– At $0.11/kWh: 21.7% ROI over 5 years, payback in 4.6 years.

– At $0.17/kWh: 31.7% ROI over 5 years, payback in 3.8 years.

Environmental Impact

1. CO₂ Reduction

– Captures 4.5 million tons/year; biochar sequesters 146,000 tons/year.

2. Waste Diversion

– Reduces landfill waste by 219,000–438,000 tons/year, cutting methane emissions by ~80,000 tons CO₂e/year.

3. Food Security

– Produces 36,500 tons of vegetables and 73,000 tons of algae food, saving $50–75 million in imports annually.

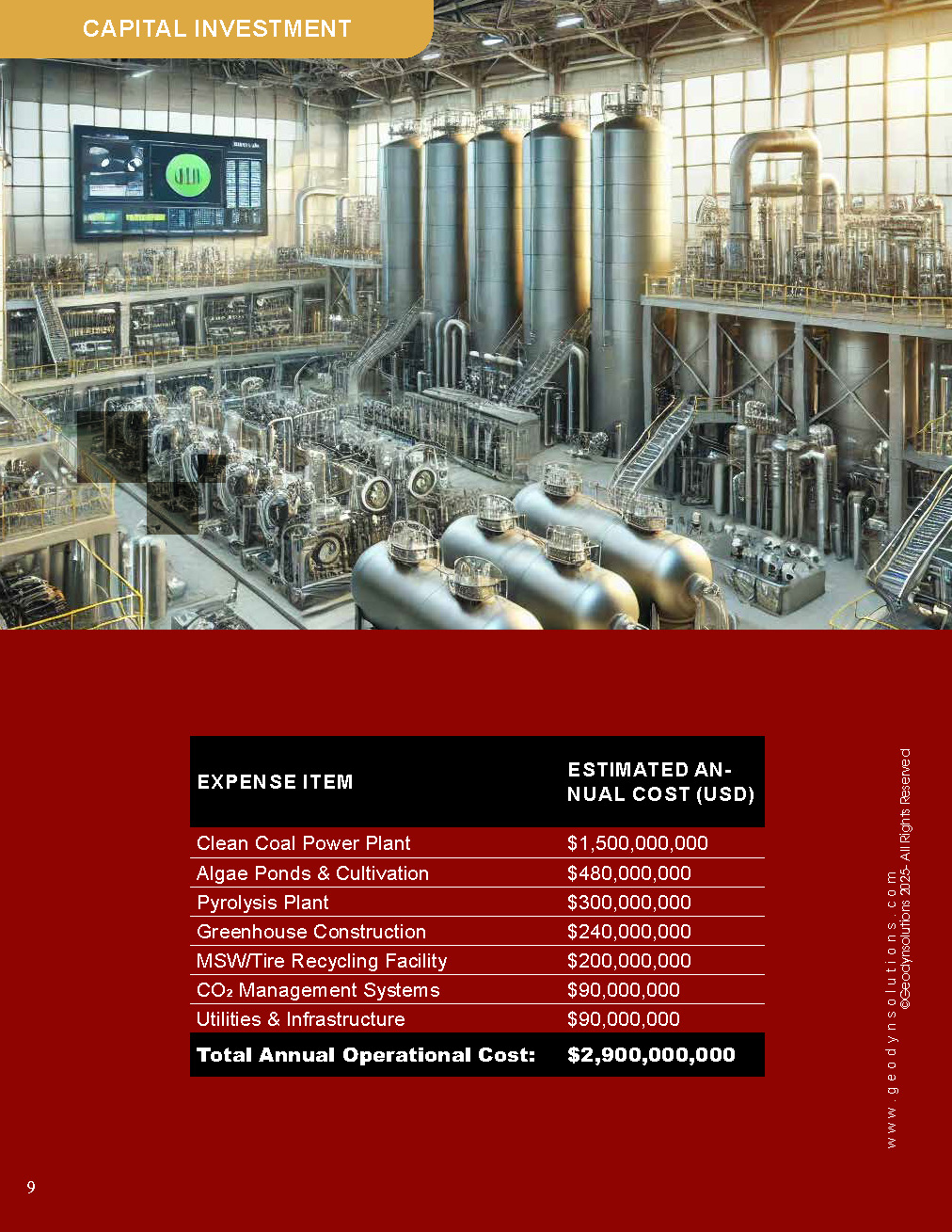

Capital Investment

| Expense Item | Estimated Cost (USD) |

|---|---|

| Clean Coal Power Plant | $1,500,000,000 |

| Algae Ponds & Cultivation | $480,000,000 |

| Pyrolysis Plant | $300,000,000 |

| Greenhouse Construction | $240,000,000 |

| MSW/Tire Recycling Facility | $200,000,000 |

| CO₂ Management Systems | $90,000,000 |

| Utilities & Infrastructure | $90,000,000 |

| Total Investment | $2,900,000,000 |

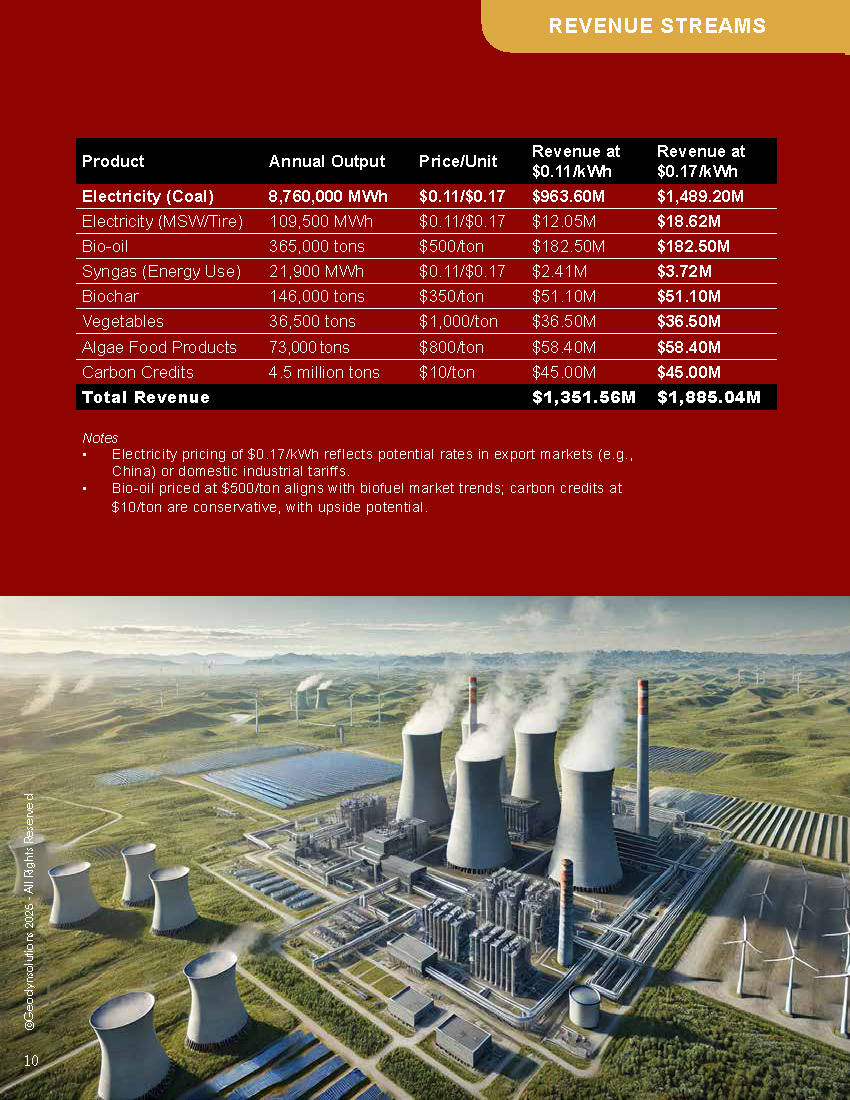

Revenue Streams

| Product | Annual Output | Price/Unit | Revenue at $0.11/kWh | Revenue at $0.17/kWh |

|---|---|---|---|---|

| Electricity (Coal) | 8,760,000 MWh | $0.11/$0.17 | $963.60M | $1,489.20M |

| Electricity (MSW/Tire) | 109,500 MWh | $0.11/$0.17 | $12.05M | $18.62M |

| Bio-oil | 365,000 tons | $500/ton | $182.50M | $182.50M |

| Syngas (Energy Use) | 21,900 MWh | $0.11/$0.17 | $2.41M | $3.72M |

| Biochar | 146,000 tons | $350/ton | $51.10M | $51.10M |

| Vegetables | 36,500 tons | $1,000/ton | $36.50M | $36.50M |

| Algae Food Products | 73,000 tons | $800/ton | $58.40M | $58.40M |

| Carbon Credits | 4.5 million tons | $10/ton | $45.00M | $45.00M |

| Total Revenue | $1,351.56M | $1,885.04M |

Notes:

– Electricity pricing of $0.17/kWh reflects potential rates in export markets (e.g., China) or domestic industrial tariffs.

– Bio-oil priced at $500/ton aligns with biofuel market trends; carbon credits at $10/ton are conservative, with upside potential.

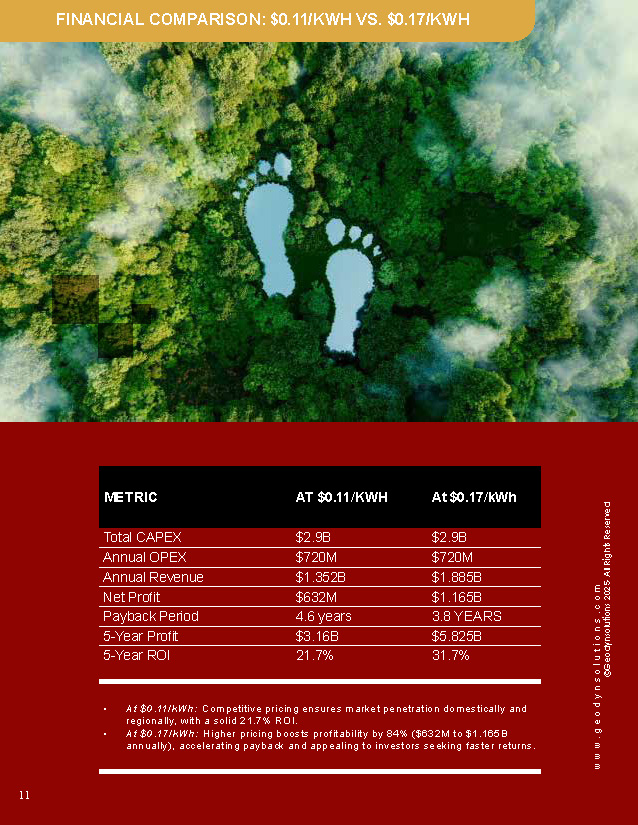

Financial Comparison: $0.11/kWh vs. $0.17/kWh

| Metric | At $0.11/kWh | At $0.17/kWh |

|---|---|---|

| Total CAPEX | $2.9B | $2.9B |

| Annual OPEX | $720M | $720M |

| Annual Revenue | $1.352B | $1.885B |

| Net Profit | $632M | $1.165B |

| Payback Period | 4.6 years | 3.8 years |

| 5-Year Profit | $3.16B | $5.825B |

| 5-Year ROI | 21.7% | 31.7% |

– At $0.11/kWh: Competitive pricing ensures market penetration domestically and regionally, with a solid 21.7% ROI.

– At $0.17/kWh: Higher pricing boosts profitability by 84% ($632M to $1.165B annually), accelerating payback and appealing to investors seeking faster returns.

Implementation Timeline

1. Planning (12 Months) : Feasibility studies, permits, and funding ($1.45B debt at 5%, $1.45B equity).

2. Construction (36 Months) : Phased build-out of all facilities.

3. Commissioning (12 Months) : Testing and operational launch by Year 5.

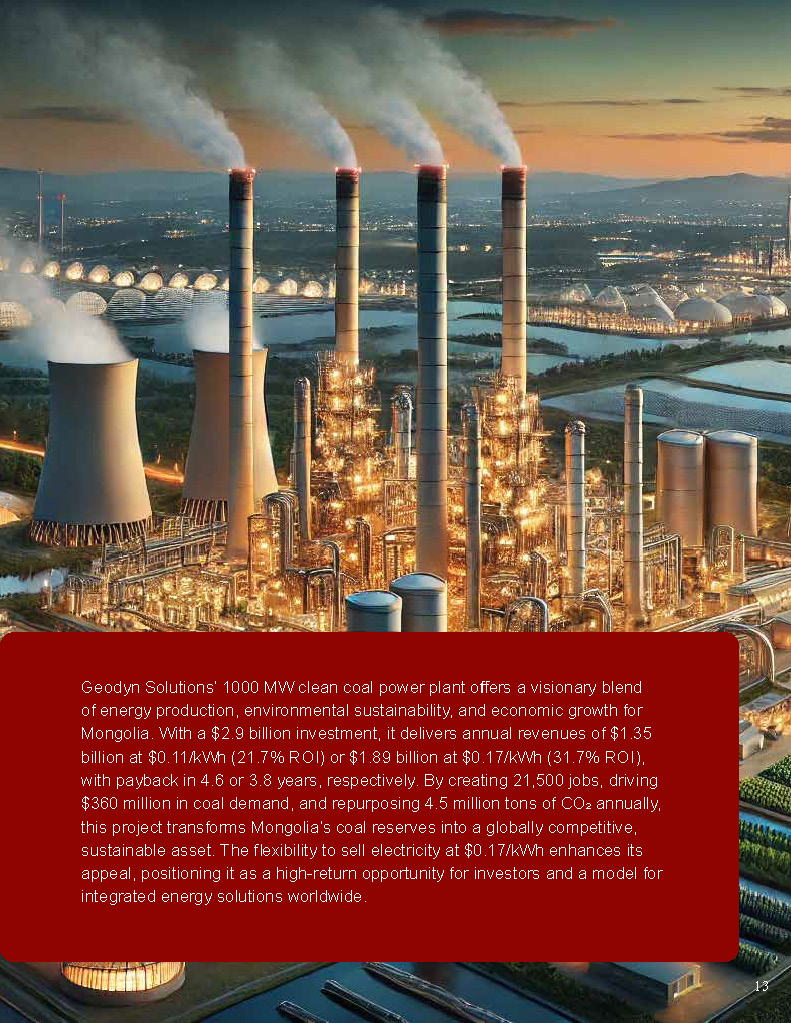

Conclusion

Geodyn Solutions’ 1000 MW clean coal power plant offers a visionary blend of energy production, environmental sustainability, and economic growth for Mongolia. With a $2.9 billion investment, it delivers annual revenues of $1.35 billion at $0.11/kWh (21.7% ROI) or $1.89 billion at $0.17/kWh (31.7% ROI), with payback in 4.6 or 3.8 years, respectively. By creating 21,500 jobs, driving $360 million in coal demand, and repurposing 4.5 million tons of CO₂ annually, this project transforms Mongolia’s coal reserves into a globally competitive, sustainable asset. The flexibility to sell electricity at $0.17/kWh enhances its appeal, positioning it as a high-return opportunity for investors and a model for integrated energy solutions worldwide.