Geodyn Solutions proposes a 100,000 barrels/day Coal-to-Liquids (CTL) facility with integrated power generation for Mongolia

Executive Summary

Geodyn Solutions proposes a 100,000 barrels/day Coal-to-Liquids (CTL) facility with integrated power generation for Mongolia. This advanced system converts coal into liquid fuels via Indirect Coal Liquefaction (ICL) or Direct Coal Liquefaction (DCL), while co-generating electricity from waste heat or syngas. Designed to leverage Mongolia’s vast coal reserves, this project will meet surging demand for liquid fuels and electricity, delivering significant economic benefits, including thousands of jobs and a strong return on investment (ROI).

Process Description

The CTL facility will produce 100,000 barrels/day of synthetic liquid fuels (e.g., diesel, gasoline) using:

- Indirect Coal Liquefaction (ICL): Gasifies coal into syngas, then synthesizes it into hydrocarbons.

- Direct Coal Liquefaction (DCL): Directly hydrogenates coal into liquid fuels under high pressure.

Co-generation utilizes waste heat or excess syngas to produce electricity (estimated 500-700 MW), enhancing efficiency and providing a secondary revenue stream.

Economic Analysis

| Category | Details |

|---|---|

| Capital Cost | Approximately $15-20 billion USD for a 100,000 barrels/day facility, including reactors, gasification units, power generation infrastructure, and carbon mitigation systems. |

| Operational Expenses | Annual costs of $1.5-2 billion, driven by coal feedstock ($50-70/ton), labor, energy inputs, and maintenance. Co-generation reduces net costs by $200-300 million/year through electricity sales. |

| Efficiency | Liquid fuel efficiency of 30%-40%, with total system efficiency reaching 50%-60% including power generation. |

| Revenue Potential | At $70/barrel (conservative estimate), liquid fuel sales yield $2.6 billion annually, plus $150-200 million from electricity (assuming $0.08/kWh). Total revenue: $2.75-2.8 billion/year. |

| Return on Investment (ROI) | With annual net profits of $750 million-$1 billion after operational costs, ROI is projected at 5%-7% per year, with breakeven in 15-20 years (assuming stable fuel prices and government incentives). |

Job Creation

| Category | Details |

|---|---|

| Capital Cost | Approximately $15-20 billion USD for a 100,000 barrels/day facility, including reactors, gasification units, power generation infrastructure, and carbon mitigation systems. |

| Operational Expenses | Annual costs of $1.5-2 billion, driven by coal feedstock ($50-70/ton), labor, energy inputs, and maintenance. Co-generation reduces net costs by $200-300 million/year through electricity sales. |

| Efficiency | Liquid fuel efficiency of 30%-40%, with total system efficiency reaching 50%-60% including power generation. |

| Revenue Potential | At $70/barrel (conservative estimate), liquid fuel sales yield $2.6 billion annually, plus $150-200 million from electricity (assuming $0.08/kWh). Total revenue: $2.75-2.8 billion/year. |

| Return on Investment (ROI) | With annual net profits of $750 million-$1 billion after operational costs, ROI is projected at 5%-7% per year, with breakeven in 15-20 years (assuming stable fuel prices and government incentives). |

| Construction Phase | 8,000-10,000 jobs over 4-5 years, including engineers, laborers, and support staff. |

| Operational Phase | 1,500-2,000 permanent jobs, including plant operators, technicians, logistics personnel, and administrative roles. |

| Indirect Jobs | 5,000-7,000 additional jobs in coal mining, transportation, and downstream industries (e.g., fuel distribution). |

| Total Economic Impact | Up to 20,000 jobs over the project lifecycle, significantly boosting Mongolia’s employment rate. |

Advantages

| Category | Details |

|---|---|

| Energy Security | Produces 36.5 million barrels of fuel annually, reducing Mongolia’s reliance on imported oil. |

| Power Supply | Co-generates 500-700 MW of electricity, supporting industrial growth and rural electrification. |

| Economic Stimulus | High job creation and revenue generation enhance GDP and local development. |

| Resource Optimization | Utilizes Mongolia’s 170 billion tons of coal reserves for maximum value. |

Challenges

| Category | Details |

|---|---|

| High Investment | $15-20 billion upfront cost requires substantial financing, likely through public-private partnerships or international loans. |

| Carbon Footprint | Emissions-intensive process demands carbon capture and storage (CCS), adding $1-2 billion to capital costs. |

| Market Volatility | Fluctuating oil prices could affect ROI, necessitating long-term contracts or subsidies. |

Strategic Fit for Mongolia

Mongolia’s energy profile aligns perfectly with this project:

| Category | Details |

|---|---|

| Fuel Demand | High import dependency (over 90% of liquid fuels) creates a $2-3 billion annual market for CTL products. |

| Coal Abundance | Vast reserves ensure a stable, low-cost feedstock. |

| Electricity Needs | Growing demand (current capacity ~1,500 MW) benefits from additional power generation. |

Proposed Implementation

| Category | Details |

|---|---|

| Site Selection | Near Tavan Tolgoi coal basin, with access to rail and water resources. |

| Capacity | 100,000 barrels/day of liquid fuels + 500-700 MW electricity. |

| Financing | $15-20 billion via Mongolian government equity (20%), international loans (50%), and private investment (30%). |

| Sustainability | CCS integration to capture 5-7 million tons CO₂/year, aligning with global standards. |

| Timeline | Feasibility study (12 months), financing (18 months), construction (4-5 years), operational launch by 2032. |

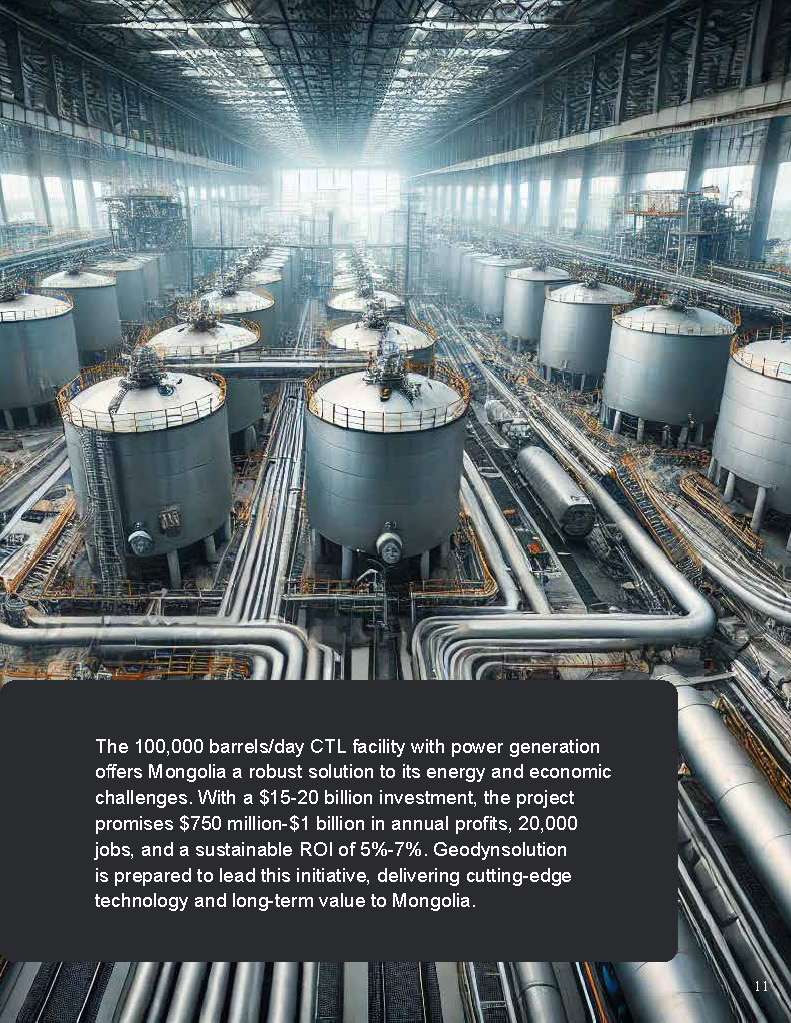

Conclusion

The 100,000 barrels/day CTL facility with power generation offers Mongolia a robust solution to its energy and economic challenges. With a $15-20 billion investment, the project promises $750 million-$1 billion in annual profits, 20,000 jobs, and a sustainable ROI of 5%-7%. Geodynsolution is prepared to lead this initiative, delivering cutting-edge technology and long-term value to Mongolia.